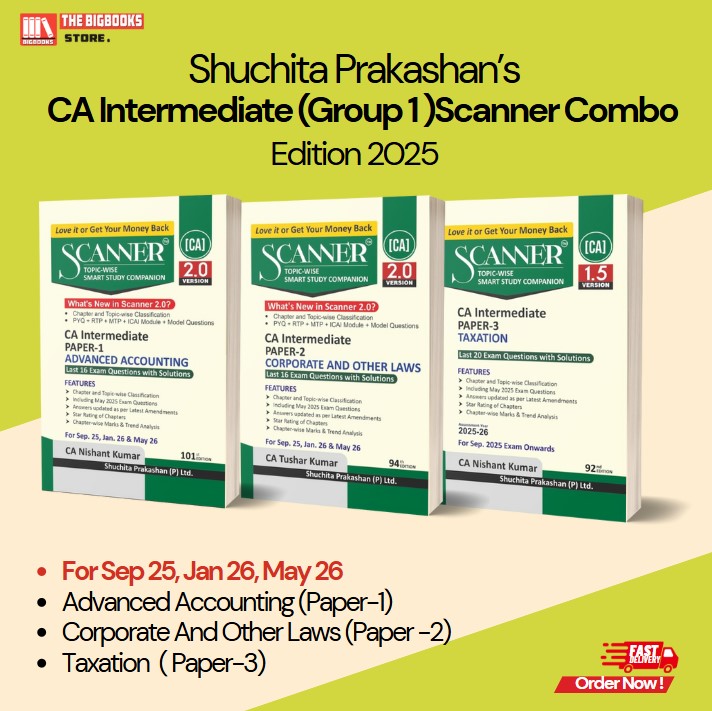

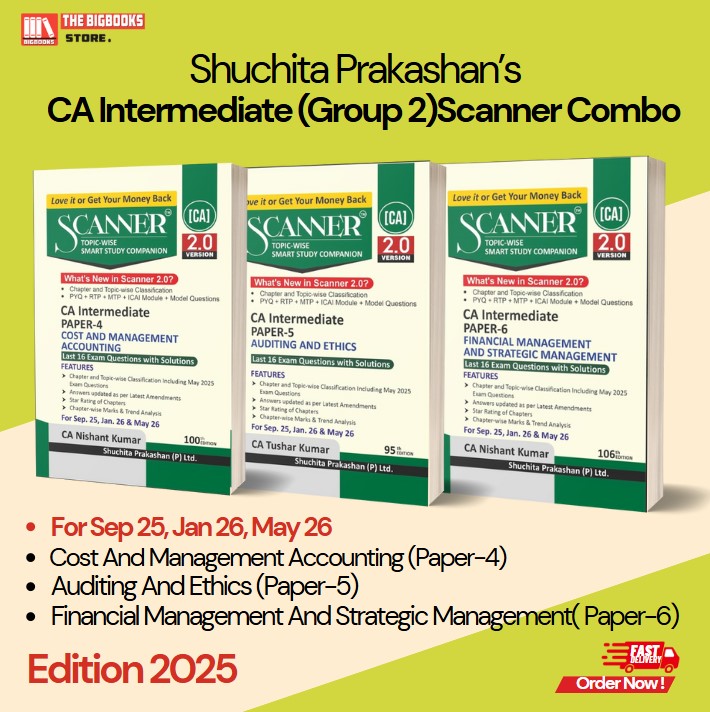

Shuchita Prakashan’s CA Intermediate Scanner Combo (Group 1) Advanced Accounting (Paper-1), Corporate And Other Laws (Paper -2), Taxation ( Paper-3) For Sep 25, Jan 26, May 26 - Edition 2025

| Author : | CA Nishant Kumar |

|---|

Shuchita Prakashan’s CA Intermediate Scanner Combo (Group 1) – Advanced Accounting (Paper-1), Corporate and Other Laws (Paper-2), Taxation (Paper-3)

Shuchita Prakashan’s CA Intermediate Scanner Combo (Group 1) – 2025 Edition is a must-have preparatory resource designed for students appearing in the CA Intermediate exams under the ICAI’s new syllabus. The combo includes three subject-wise volumes: Advanced Accounting (Paper-1), Corporate and Other Laws (Paper-2), and Taxation (Paper-3)—meticulously compiled and updated to suit the latest exam trends and question patterns.

This combo is tailored to help aspirants systematically revise all key topics, solve past exam questions, understand examiner expectations, and gain conceptual clarity. With detailed chapter-wise solutions, MCQs, and ICAI exam analysis, it equips students with the tools needed to boost confidence and ensure effective exam preparation.

Key Features:

-

📚 Chapter-Wise Solved Questions:

Questions from past ICAI exams (including RTPs & MTPs) sorted chapter-wise to enhance conceptual understanding and practice. -

🧾 Updated as per Latest Syllabus:

Fully aligned with ICAI’s revised CA Intermediate curriculum and applicable for Sep 2025, Jan 2026, and May 2026 attempts. -

🧠 Detailed Answers & Hints:

Each solution is well-explained and structured to help students understand the reasoning behind correct answers and develop problem-solving skills. -

🧑🎓 Covers Three Critical Subjects:

-

Paper 1 – Advanced Accounting: Includes accounting standards, company accounts, and advanced problems.

-

Paper 2 – Corporate and Other Laws: Covers Companies Act, Contract Act, LLP Act, and other key legal provisions.

-

Paper 3 – Taxation: Includes both direct and indirect tax topics with latest amendments, examples, and MCQs.

-

-

📝 Based on ICAI Question Patterns:

Reflects current trends in paper-setting to ensure students are well-prepared for actual exam scenarios. -

📈 Performance-Boosting Resource:

Ideal for last-minute revisions, practice, and concept reinforcement across all key topics.

Why This Book is Essential:

-

✅ Trusted by Toppers:

A go-to choice among CA aspirants for its clarity, accuracy, and exhaustive coverage of exam-relevant content. -

📖 Exam-Oriented Format:

Focuses on frequently asked questions, trend analysis, and examiner expectations for targeted preparation. -

🧾 Covers Amendments & ICAI Updates:

Integrates the latest changes from ICAI notifications and Finance Acts to ensure accuracy. -

💡 Helps Improve Speed & Accuracy:

Designed to build exam temperament by offering sufficient question practice and time-management strategies. -

🧰 One Combo for All Needs:

Eliminates the need for multiple resources—this single combo serves all academic and practice needs for Group 1.