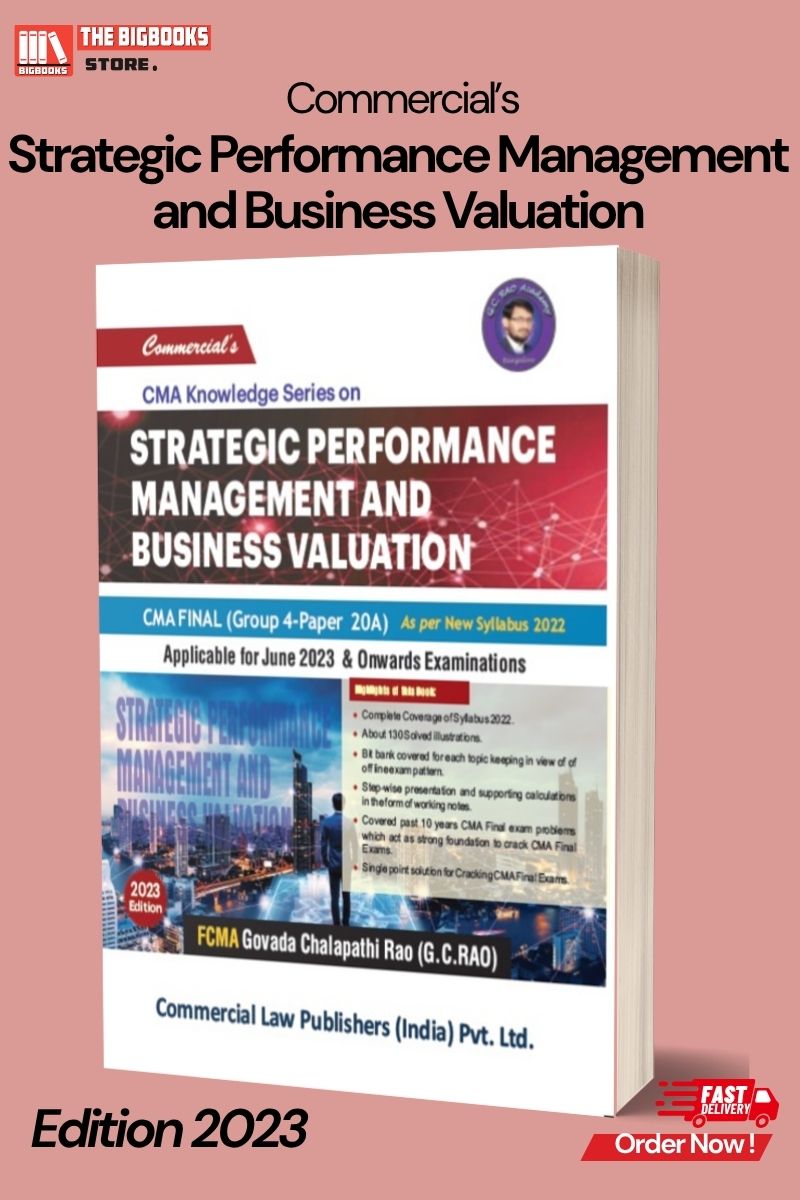

CMA Knowledge Series on Strategic Performance Management and Business Valuation (CMA Final Group 4 Paper 20A) - Edition 2023

| Author : | G.C Rao |

|---|

Commercial's CMA Knowledge Series on Strategic Performance Management and Business Valuation (CMA Final Group 4 – Paper 20A) is a comprehensive resource for CMA Final aspirants. It covers essential concepts such as performance management frameworks, balanced scorecards, valuation methods, and strategic decision-making tools. This edition aligns with the ICMAI syllabus and includes illustrative examples, case studies, and objective-type questions, making it ideal for mastering both theoretical and practical aspects of Paper 20A.

250

English

2023

Share this product

CMA Knowledge Series on Strategic Performance Management and Business Valuation (CMA Final Group 4 – Paper 20A)

CMA Knowledge Series on Strategic Performance Management and Business Valuation (SPMBV) is a specialized and exam-oriented book crafted for students preparing for CMA Final – Group 4, Paper 20A. It provides an in-depth understanding of the strategic aspects of performance evaluation and contemporary techniques of business valuation, aligned with the latest ICMAI syllabus and industry best practices.

This book is designed to bridge academic learning with real-world financial strategy. It emphasizes the application of performance metrics, value-based management, and corporate valuation models that are essential for decision-making in modern business environments. With its clear conceptual framework, illustrative problems, and strategic insights, this book is a must-have tool for CMA aspirants and professionals alike.

🔍 Key Features:

-

✅ Comprehensive Coverage of ICMAI Syllabus:

-

Includes topics like Strategic Performance Measurement, Balanced Scorecard, EVA, MVA, Business Valuation Approaches, and Forecasting Techniques.

-

Fully mapped to the CMA Final Paper 20A syllabus, with detailed theoretical explanations and practical applications.

-

-

💼 Strategic and Financial Focus:

-

Discusses performance evaluation through both financial and non-financial metrics, linking them with business objectives.

-

Covers valuation of shares, businesses, intangibles, and start-ups using modern and traditional valuation methods.

-

-

📘 Solved Examples & Case Studies:

-

Each chapter contains illustrative problems, case-based questions, and real-life examples for practical clarity.

-

Provides model answers, working notes, and valuation computations to boost exam readiness.

-

-

🧠 Learning-Oriented Layout:

-

Concept summaries, revision notes, and flowcharts provided for quick understanding and memorization.

-

Multiple choice questions, self-practice problems, and past exam trends included at the end of each chapter.

-

-

📊 Tools for Real-World Application:

-

Learn how to apply valuation models like DCF, NAV, Earnings Multiples, and Relative Valuation in actual business scenarios.

-

Insightful discussion on risk analysis, forecasting, and value creation strategies.

-

👥 Recommended For:

-

CMA Final students preparing for Group 4 – Paper 20A

-

Finance professionals involved in business strategy, valuation, and corporate performance management

-

Trainers and academicians in the field of cost and management accounting